iowa capital gains tax 2021

Eligibility for the deduction is. 41-158b 07062021 Instructions for 2021 IA 100D Iowa Capital Gain Deduction Sale of Timber.

Capital Gains Tax Brackets For 2022 And 2023 The College Investor

IA 100A - IA 100F Capital Gain Deduction Information and Links to Forms Instructions 41-161.

. 1 week ago Oct 12 2022 In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. Paying Capital Gains Tax in Iowa. Iowa does not tax capital gains resulting from the sale of property used in trade or business for at least 10 years.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. 2021 Enter 100 of any capital gain or loss as reported on federal form 1040 line 7. However it was struck down in.

How Much Is Capital Gains Tax In Iowa. In the case of installment sales of qualifying property only installments received in the 2021 tax year qualify for the capital gain deduction on the 2021 return. This means no capital gains tax is owed at the.

Long-term capital gains rates are 0 15 or 20 and married couples. Long-term capital gains rates are 0 15 or 20 and married couples. Iowa is a somewhat different story.

2022 capital gains tax rates. The taxpayer may claim a 4000 income adjustment on line 24 of the 2021 Iowa return. 2021-2022 Capital Gains Tax Rates Calculator 1 week ago 2021 capital gains tax calculator.

10200 of those benefits. - Law info 1 week ago Jun 30 2022 What will capital gains tax be in 2021. 1 week ago Anyone earning beyond 441450 and for married couples 496600 face a capital gains tax rate of 20.

What is the Iowa capital gains tax rate 2020 2021. Use the following flowcharts to assist you in completing the applicable IA 100 forms and determining whether you have a qualifying Iowa capital gain deduction. Short-term gains are taxed as ordinary income.

Iowa has a relatively high capital gains tax rate of 853 but the amount an individual. A taxpayer received 20000 Iowa unemployment benefits in 2020. Long-term capital gains rates are 0 15 or 20 and married couples.

A copy of your federal Schedule D and federal form 8949 if applicable must be included with this return. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on. However the actual rates are lower because iowa has a unique deduction for federal income taxes from.

- Law info 1 day ago Jun 30 2022 What will capital gains tax be in 2021. How Much Is Capital Gains Tax In Iowa. How Much Is Capital Gains Tax In Iowa.

Thats also true of other. - Law info 4 days ago Jun 30 2022 What will capital gains tax be in 2021. 2021 IA 100D Instructions page 2.

52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The Iowa capital gain deduction is subject to review by. Includes short and long-term Federal and.

When a landowner dies the basis is automatically reset to the current fair. Capital gains tax rates are an important consideration for every investor because youll have to pay capital gains tax on stocks when you sell them. At the 22 income tax bracket the federal capital gain tax rate is 15.

In 2021 for an individual earning less than 40000 a year or a married couple who file jointly earning 80000 the capital gains tax is 0.

Capital Gains Tax In Washington State Is It About Fairness And Funding Or Will It Drive Away Startups Geekwire

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Struggle Over Tax Break For Inherited Farmland Churns Below Surface In Reconciliation Bill Iowa Capital Dispatch

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq

Elimination Of Stepped Up Basis Poses Hazards To Family Farms

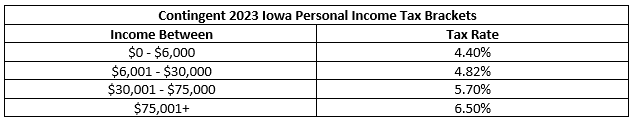

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Income Tax Calculator Smartasset

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Tax Calculator Estimate What You Ll Owe

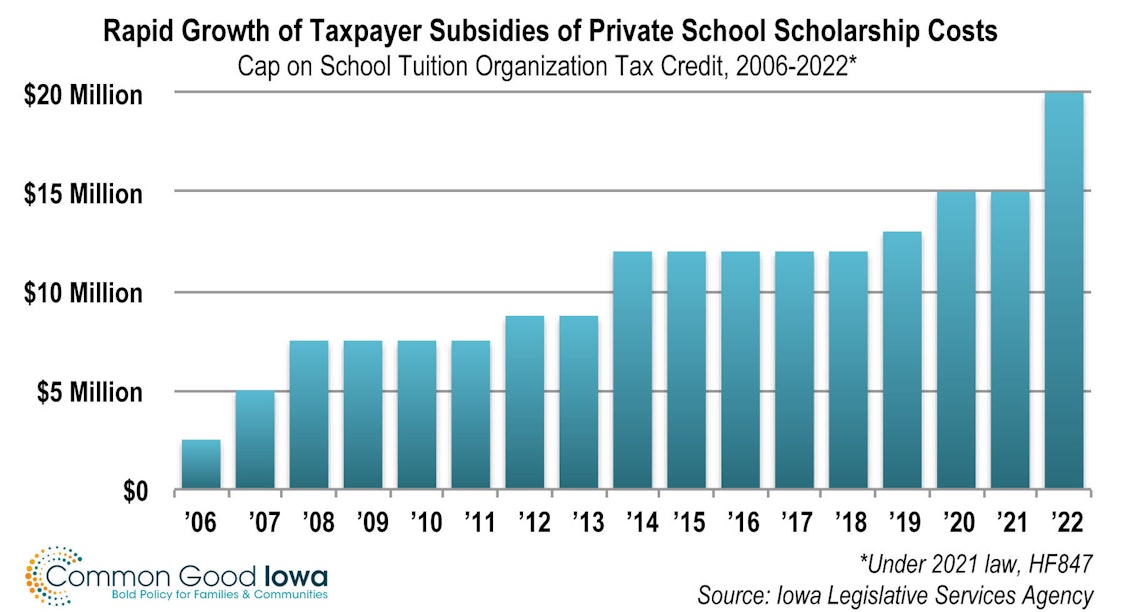

Iowa Republicans Weigh Ending State Income Tax But Hurdles Remain

Capital Gains Tax Rates By State Nas Investment Solutions

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Real Estate Capital Gains Tax Rates In 2021 2022

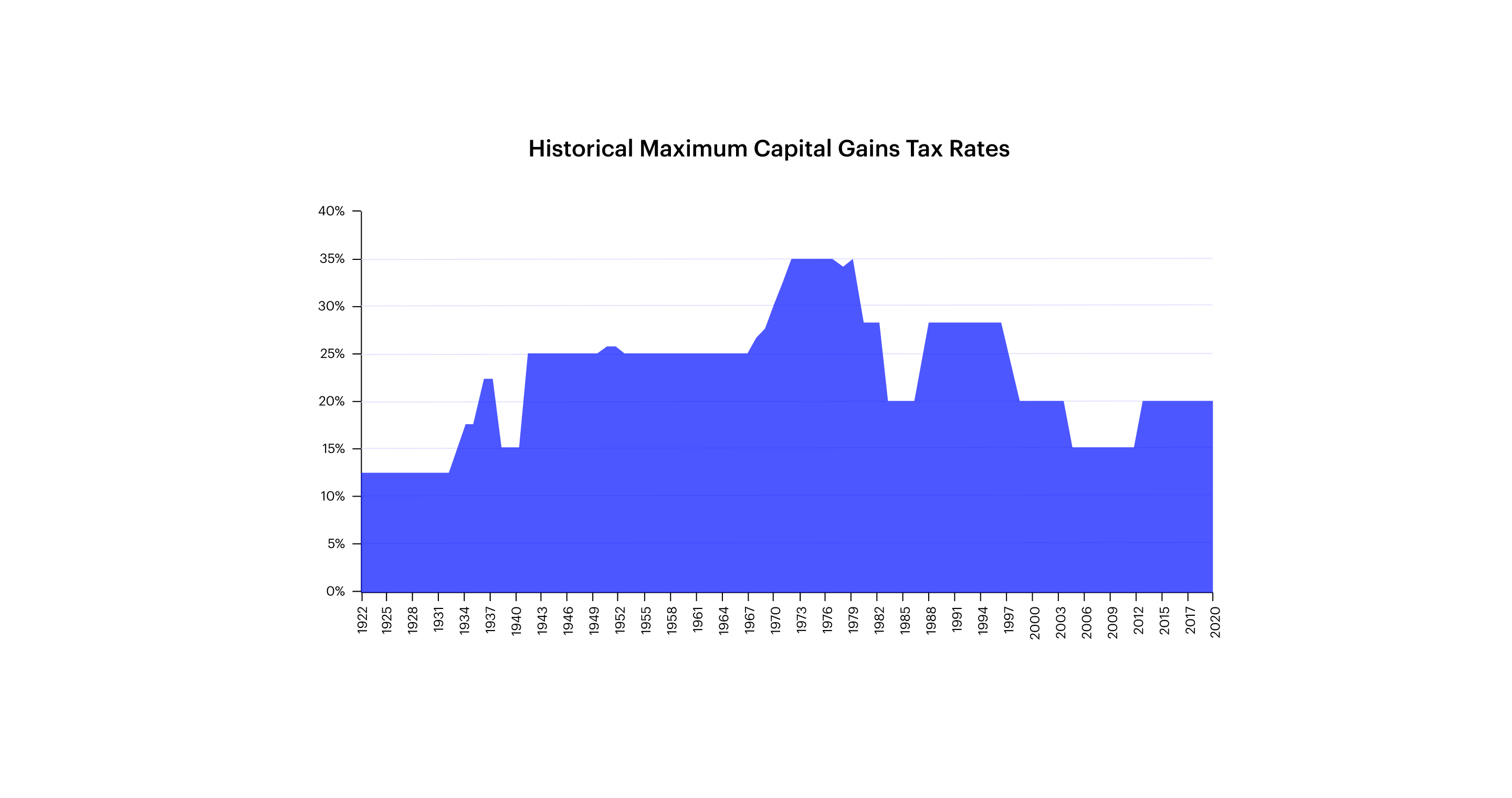

The High Burden Of State And Federal Capital Gains Tax Rates In The United States Tax Foundation

Capital Gains Tax Calculator Estimate What You Ll Owe

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Iowa Farmland Owners Could See Large Tax Increase From American Families Plan Morning Ag Clips