why do tech stocks sell off when interest rates rise

The sharp increase this month in US. Youd think a faster-growing economy would spur tech shares to ever.

The 20 Best Canadian Tech Stocks For 2022 Hardbacon

The lift in.

. When the Federal Reserve raises interest rates it causes the stock market to go down. While members of the NYSE FANG index. BEIJING China Global stocks rose Thursday after the Federal Reserve chairman downplayed the likelihood of bigger interest rate hikes following the US.

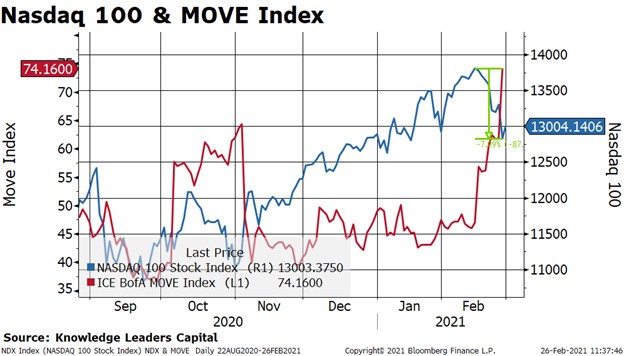

For bonds expectations of increasing interest rates mean investors in the primary market earn higher coupons on new issues. Government-bond yields is pressuring the stock market and forcing investors to more seriously confront the implications of rising interest rates. Central bank can influence the stock market in a variety of ways.

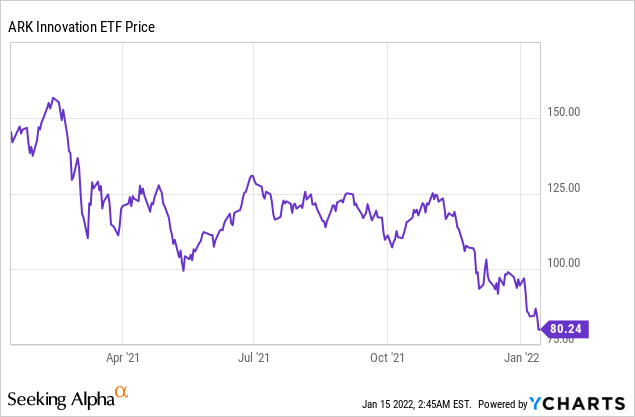

16 hours agoMay 4 2022 419pm PDT. Conventional wisdom tells us that we should avoid tech stocks in an increasing interest rate scenario. Fast-growing technology stocks have been slammed because of rising bond yields amid expectations for stronger economic growth.

Tech Stocks Drop Amid Rising Bond Yields Investors bets on economic rebound have contributed to selloff in government bonds. Here are a few stock sectors considered to be defensive investments. 14 2022 in the Financial District.

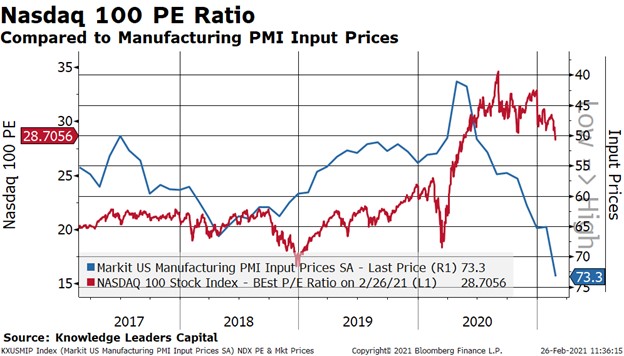

When a companys costs rise its profit margins can dip even if sales continue apace. 3 hours agoBig spenders lead the way. Also Hammered as Interest Rates Rise.

As a general rule of thumb when the Federal Reserve cuts interest rates it causes the stock market to go up. Now that I threw a wrench in the higher interest rate taking down growth stocks story I want to take a second to actually myself. Rising bond yields could keep a choke hold on tech and growth stocks for now as investors bet the Federal Reserve will raise interest rates four or more times this year.

The big selloff in the technology sector isnt simply a US. Wall Street is off to a mixed start on Wednesday May 4 and bond yields. Tenable has grown its annual revenue at a compounded rate of 34 since 2016.

Stocks tumbled Monday. Depending on their portfolios investors may see certain sectors weakened and other sectors. But non-cyclical or defensive stocks are more suitable before a.

Dow experiencing worst day since Oct 2020. The Wall Street street sign is framed by the American flags flying outside the New York Stock Exchange Friday Jan. In its recent Q1 2022 earnings report the company also issued revenue guidance for the full.

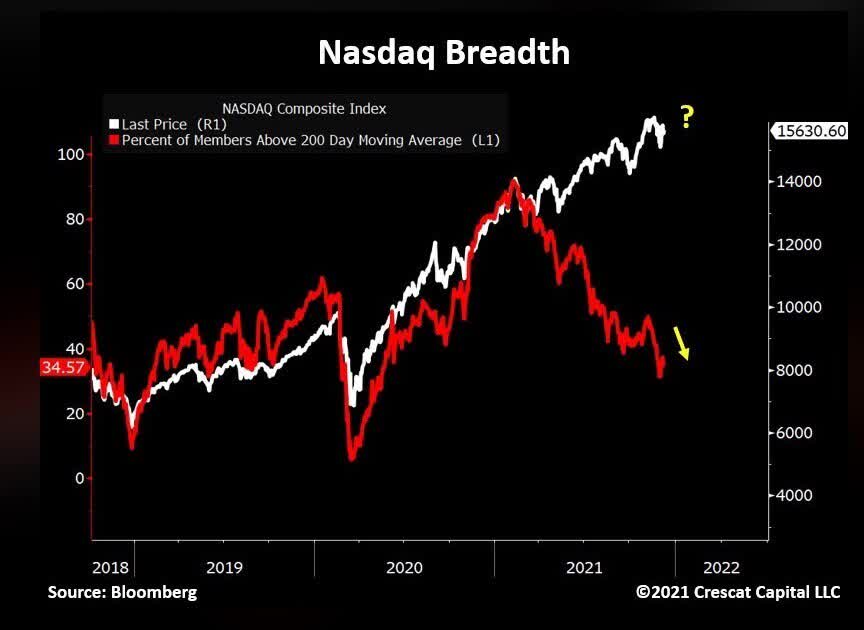

Therefore unprofitable tech companies that are trading at frothy valuations usually suffer the most as interest rates rise. Large-cap technology stocks usually are market leaders when interest rates are rising. A simplified way to think about why bond prices fall when rates rise is this.

Crowding is a risk because it may mean that even a relatively minor negative news event for a tech leader could trigger a sell-off and a sharper-than-expected downdraft for the broader market. Consumer staples non-cyclical investments. Amazon is among the big tech stocks losing ground so far this year.

8 minutes agoStocks give up gains from post-Fed rate hike rally. Thats why Twilio TWLO 555 a high-growth cloud communications. Large-cap tech stocks could face increasing.

Remember at current levels with US 10-year bond yields still below 15 per cent a return to something even approaching a more normal rate of 3 per cent would see interest rates more than double. Consumer discretionary cyclical stocks will typically perform best during the peak times of the economic cycle and during the early stages of rising interest rates. I actually do think its possible that higher rates can take down growth stocks if enough people believe it.

All else being equal if someone could buy a 10-year bond paying 15 interest a year or a shorter-term bond that pays. SHARE Fed raises interest rates by 05 the highest rise since 2000. However tech stocks are fundamental for healthy portfolio returns.

The NASDAQ 100 Technology index which. This puts pressure on prices of outstanding bonds in the secondary. If we keep seeing stories that higher rates are bad for growth stocks and growth stocks start to.

Thats because the companies sell more software and equipment as consumers and businesses typically increase their tech spending in a growing economyand they earn higher interest rates on their massive cash reserves. Paulina Likos July 16 2021. 453 AM PDT May 5 2022.

NEW YORK AP Wall Street is shifting into reverse giving up much of the big gains it made a day. 23 January 2022 219 pm 5-min read. AP Stock market-listed technology companies the world over have seen their share prices plummet in the first few weeks of 2022 as concerns over rising inflation scare off investors.

Top 5 Tech Stocks For 2022 Seeking Alpha

Chinese Tech Stocks Fall As Tencent Shuts Game Streaming Site

Companies That Rode Pandemic Boom Get A Reality Check The New York Times

Everyone Thinks Rising Interest Rates Are Bad For Tech Stocks But Are They Institutional Investor

Why Have Tech Stocks Been Hit So Hard Morningstar

Tech Stocks Sink Nasdaq Has Worst Month Since 2008 Los Angeles Times

Should Investors Be Worried About Tech Stock Valuations The Motley Fool

Rising Rates And Or Inflation Is Not A Friend Of Technology Stocks Knowledge Leaders Capital

Buy The Crash 2 Tech Stocks For 2022 Seeking Alpha

Rising Rates And Or Inflation Is Not A Friend Of Technology Stocks Knowledge Leaders Capital

Sell Off In Tech Stocks Spreads To Private Start Ups Financial Times

Why Higher Bond Yields Are Bad News For Tech Stocks Like Amazon And Zoom Barron S

Why Does Inflation Hurt High Growth Tech Stocks The Motley Fool

Aapl Amzn Googl Tsla Msft Why Are Tech Stocks Down Today Investorplace

Rising Rates And Or Inflation Is Not A Friend Of Technology Stocks Knowledge Leaders Capital

Rising Stock Market Would Be In The Red Without A Handful Of Familiar Names The Washington Post

Everyone Thinks Rising Interest Rates Are Bad For Tech Stocks But Are They Institutional Investor